Top strategies for ensuring financial success: A complete guide

Making financial decisions is a good idea at any time of year, and many people find it easier to do so at the beginning of a new year. But the fundamentals remain the same regardless of when you begin. You need to take only a few basic steps to achieve financial success. But many people need to take these simple steps to achieve financial success over their lifetime. Most people need to consider one or more of these basic steps. This ultimately stops the process of achieving financial success.

What is your idea of financial success? Strategies to follow

It takes time to accumulate wealth and achieve financial success in your life. It’s a lifelong marathon you must keep running through, even when you hit a brick wall, which we all do at some point. You must also understand your definition of financial success and what you ultimately need for your financial legacy.

- Is your diamond becoming so valuable that it is encrusted with more diamonds?

- Does it have enough money to live comfortably in your retirement years? Or maybe it’s to be financially independent enough to leave great wealth to your family or a charitable foundation.

The pursuit of wealth is not a game. It is a means to an end. It is a means by which you achieve the following:

- Security- The desire to protect yourself and your loved ones from unknown future disasters is a good reason to collect financial assets.

- Physical ease- Money cannot buy happiness but a more pleasant form of misery.

- Free Time- Wealth means not having to wait in lines, having your agenda, and spending your time pursuing your desires rather than those of others.

- Mental peace- Knowing you have planned for any curves life throws gives you confidence, peace of mind, and satisfaction. Now, let’s look into the four strategies.

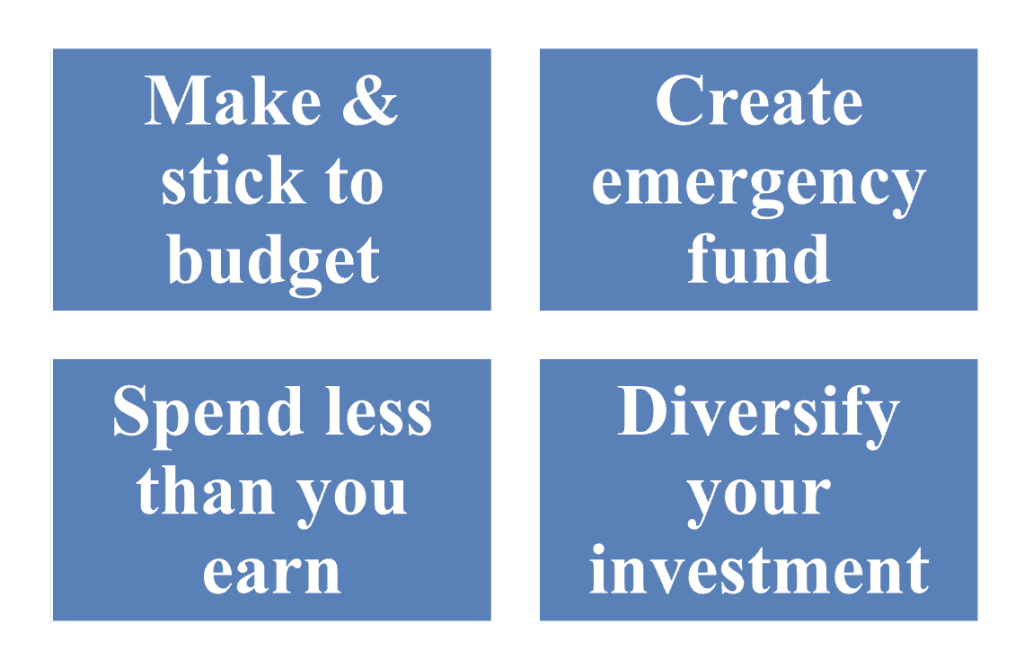

Make and stick to a budget

Proactive budgeting and forecasting are vital components of financial management. A budget can help you with the following:

- Establish spending guidelines.

- Recognize your critical financial dependencies and predict what you’d need to keep your operations running.

- Make sound financial decisions to achieve your business objectives.

- Maintain your focus to maximize your bottom line.

A corporate finance manager, in particular, must be fully aware of what gross profits and operational expenses are now and what they will become. As a result, a careful planner can minimize all deductions from the top line to maximize the ultimate bottom line (net profits). Begin by asking your team the following questions to establish a clear budget:

- What are the anticipated sales for the time?

- What are the costs of direct sales? Implementations and materials

- What are the operating costs, including overhead? Payroll and commissions; marketing; meals and travel; rent and utilities.

The majority of budgeting work is typically completed before the start of a new fiscal period. However, budgeting is frequent and should be an ongoing process. The finance team should conduct a budget to actual analysis monthly or quarterly. It helps to see how the company’s actual spending compares to what was originally projected in the previous period. Then measure what can be adjusted.

Create an Emergency Cash Fund

Things can go wrong. Your emergency fund should contain funds equal to at least six months of income in a cash or savings account. In other words, if you earn $60,000 after taxes, you should have at least $30,000 saved before considering other investments. Employer-provided matching funds plans allow you to build emergency funds more quickly. Employers will often match your investment dollar for dollar in a company-sponsored plan up to a certain percentage of your income. This means you earn a 100% return on your portion before you earn any investment earnings. Take advantage of any matching funds provided by your employer.

Your emergency fund should be kept in low-risk security; look into the rates offered by U.S. Treasury notes, bonds, and savings accounts from various banks and financial institutions such as CIT Bank. For example, a credit union with similar federal deposit guarantees may pay a higher interest rate on your savings than a bank. In addition, you can take the help of a paystub to maintain and manage money-related matters.

Spending less than you earn

Spending less than you earn is an obvious part of achieving financial success, but it’s amazing how many people don’t recognize it, let alone put it into practice. According to a recent study, one in every three adults has at least one debt in collections. Because they did not follow this simple principle, you could be one of them. That’s fine as long as you recognize the issue and begin to address it. Everyone has to start somewhere. The two most effective ways to stop spending more than you earn are:

- KEEP TRACK OF YOUR MONEY- Create a zero-based budget to plan for every dollar. Use only cash to fund your life. It will make it impossible to spend more than you earn.

- GET OUT OF DEBT AND STAY OUT- Being in debt means wasting money on interest and other fees. It’s also a sign that you’re spending more than you earn. If you find yourself in this position, don’t panic, focus your energy on creating a debt management plan to follow and stick to it.

Diversify your investments to achieve a balance b/w risk & reward

When you have enough insurance and an emergency fund, it’s time to seize the opportunity that can improve investment. There are numerous possible investments, each with its own features. Common stocks are popular among new investors because their prices are readily available, and securities can be easily purchased or sold most of the time. Stock in a single company or stocks in different companies can all be purchased as equity securities. Real estate is also popular due to special income tax benefits. But it is generally more expensive to buy and sell and less liquid. It is more difficult to convert your investment into cash. Whatever investment you choose, keep in mind that all investments are volatile.

They fluctuate based on the number of buyers and sellers at any given time. In comparison, we are most aware of this in the case of stocks because price changes are reported in the daily newspaper. In conclusion:

A solid financial plan that helps you in achieving your objectives will ultimately depend on what those objectives are and what your present financial situation is. The best strategy for you will be based on sound financial principles. It will assist you in increasing your overall savings for now and retirement. The financial plan you choose must be tailored to your specific circumstances.