5 Good Reasons To Go into Debt

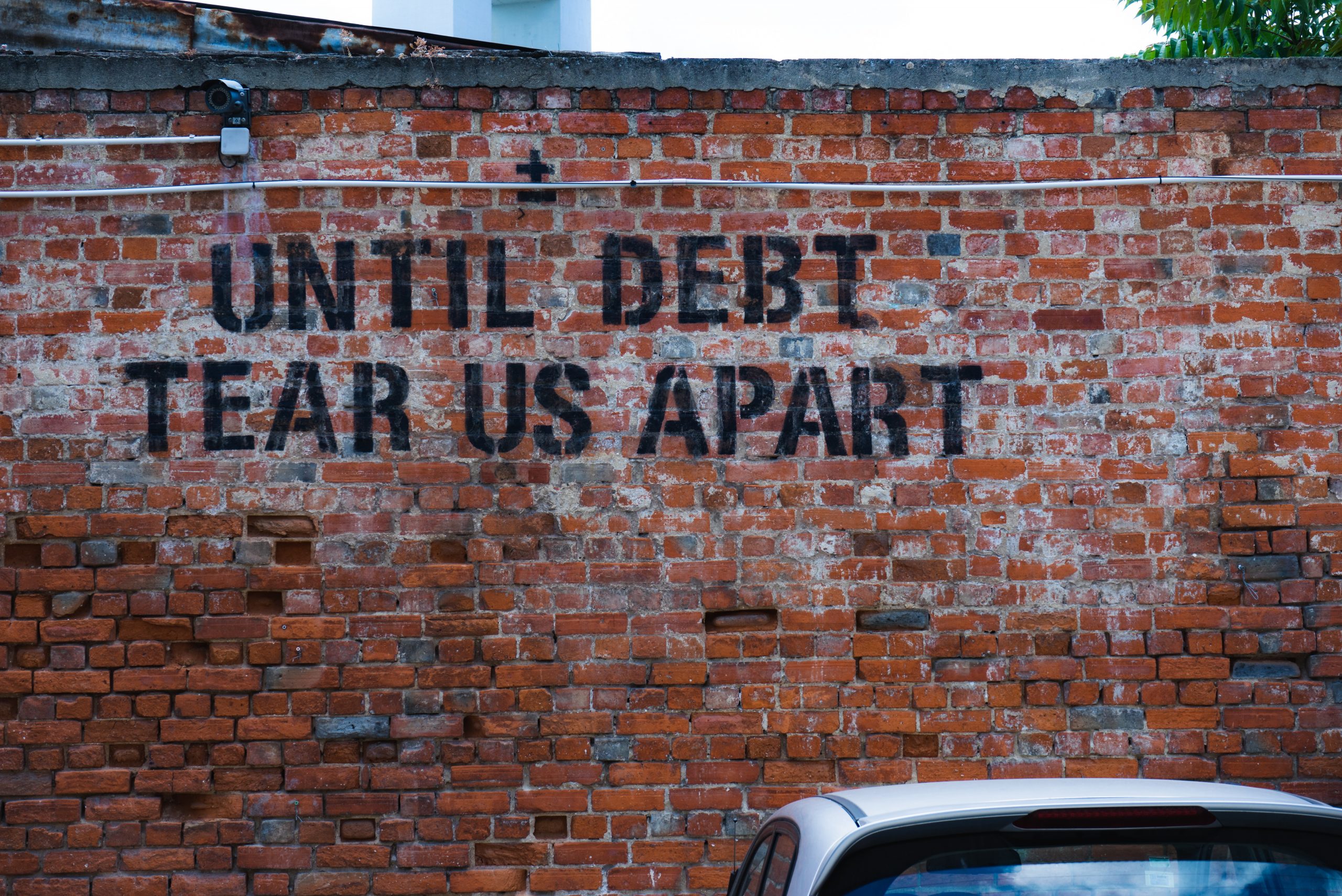

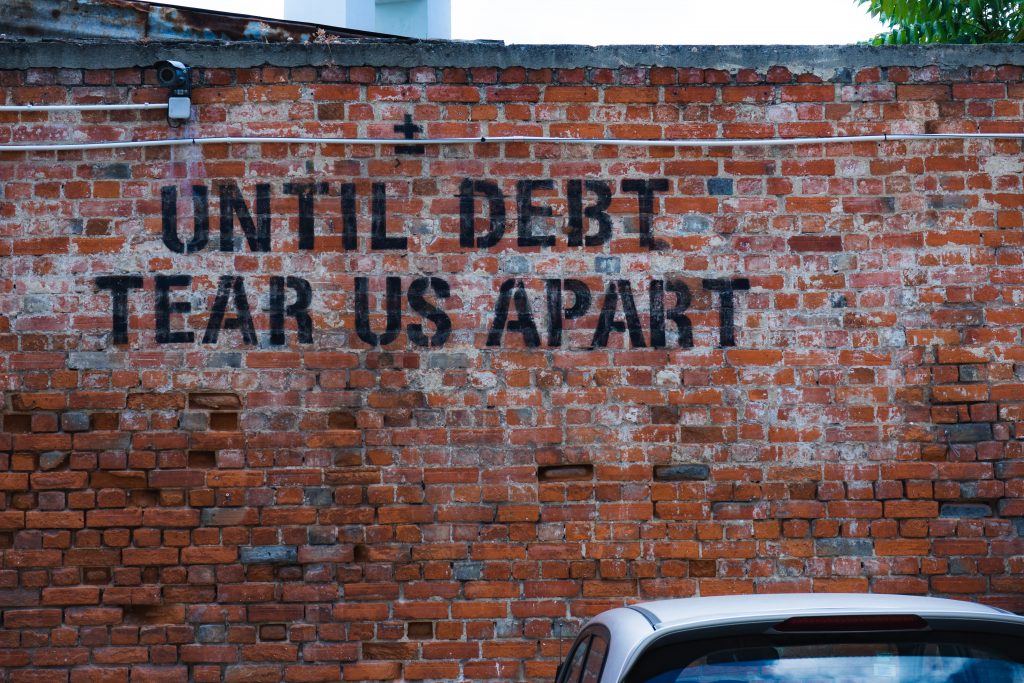

It might be a surprise to see a finance site like us to talk about debt in a positive fashion. However there are two types of debt that you can get into; good debt and bad debt.

Most people are so involved and stressed out with bad debt that they think of all debt as bad. Bad debt is set up to keep you paying someone else interest on money for as long as possible for benefits that you will have forgotten long before the original debt is paid. It is the way that a lot of the economy works for most people who work for a large portion of their month just to pay back the interest on money they have borrowed.

Good debt is different. It’s an investment, either in a current opportunity or into your future and if you are planning your future investment it is important to talk to the people who have an expert background in leveraging debt as opposed to wanting to keep you in a perpetual state of stress-inducing debt.

We don’t take this subject lightly and have been brainstorming when debt is a positive in your life, here’s what we found for you…

Buying Property

For most people the biggest expense each month is their home. If you get a mortgage at a reasonable rate you can find that you are paying no more for owning your home than you were paying in rent. As property prices generally increase, you can find that the property is worth more than you paid for it. To create a true money generating asset you could invest in further properties to rent out for more than the mortgage payments and create an extra income stream.

To build a credit history for your credit score

To get a good credit score you need to maintain some debt, although the amount that you need has been wildly exaggerated. This sort of debt is an investment in borrowing opportunities for the future. Examples of this could be a credit card or a phone contract. These can build your credit score if you keep up payments on them but will quickly ruin any benefit if you a late with even one payment. Credit cards do not charge interest on the first month after purchase, so pay them off immediately and you will avoid the interest.

Investing

If you are borrowing to invest into an opportunity to generate an income bigger than the investment and interest leaving you in profit that is a good debt. An example of this could be winning big with a small investment in online blackjack, or borrowing at an interest rate of 3% but invested into an opportunity generating returns of 10% you will be receiving a net benefit of 7%

To start a business

To set up any business you will need some operating capital. If you are borrowing to set up an income stream, it is good debt in two ways, firstly it provides you with the opportunity to create the business and secondly it shows you that your business plan is good enough for someone else to believe in and invest in, to give you the extra confidence to push forward.

To consolidate “bad” debt

If you have debt on store cards or credit cards at high interest rates it is a benefit to put the debt together at a lower interest rate. This is only true if you stop adding to your debt and do not charge anything to your cards again.

With so many people out there offering advice on money it is important to know why you are making decisions and to take advice from the right people. When advice is don’t get into debt, they are really thinking only of the “bad debt” but if you are planning your future make sure you are getting only good debt to benefit you and your lifestyle.