How Much Small Business Debt Is Too Much?

The burden of debt on small businesses is a complicated and often misunderstood subject. While some debt can act as leverage, fostering growth and expansion, too much debt can lead to financial strain and even bankruptcy. As a small business owner, it’s essential to find that perfect balance and understand how much small business debt is too much.

In this blog post, we’ll explore various aspects of small business debt, help you understand the warning signs, and offer strategies for managing it effectively.

1. Understanding Your Debt-To-Equity Ratio

Every small business owner needs to familiarize themselves with their debt-to-equity ratio, which compares the company’s total liabilities to its shareholders’ equity. By going on this page, typically available in your accounting software or financial statements, you can assess how much debt is on your books relative to your equity.

A high debt-to-equity ratio might indicate a risky financial structure and warrant caution. Aim for a balanced ratio that aligns with industry norms.

2. Monitoring Cash Flow

Image source-Pexels

Managing cash flow is vital to keeping your business solvent. Even a profitable company can run into trouble if it has more money going out than coming in.

Regularly tracking your cash flow will help you identify if your debt is becoming unmanageable. If servicing your debt becomes a strain on cash flow, it may be time to consider restructuring or paying down some of your obligations.

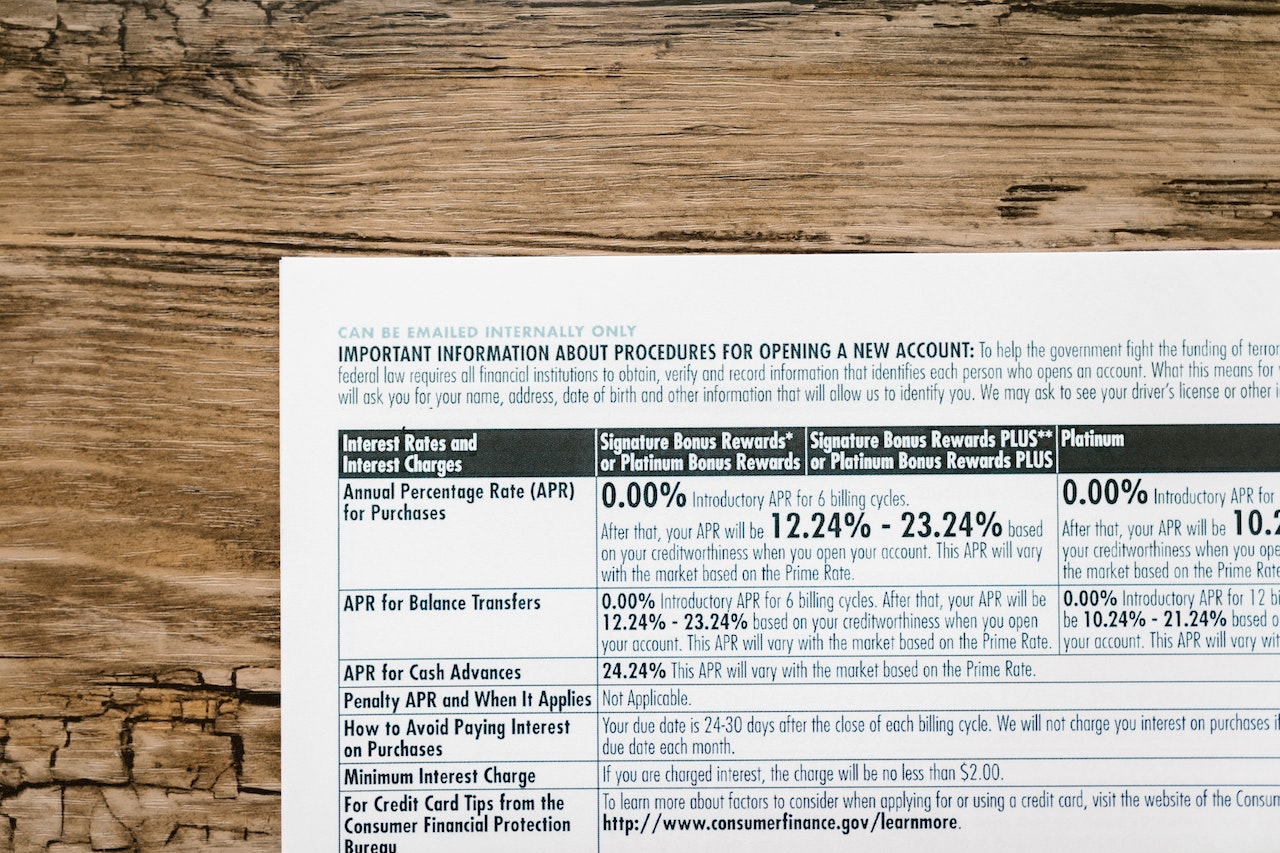

3. Assessing Interest Rate Risks

Not all debt is created equal. If your business is relying on high-interest loans or credit cards, you may find yourself sinking quickly. Always negotiate for the best interest rates and consider refinancing if a better opportunity arises.

Remember, the more you pay in interest, the less cash you’ll have for other essential aspects of your business.

4. Evaluating Loan Terms And Covenants

Understanding the terms of your loans and credit agreements is key to managing debt effectively. Are there any covenants or restrictions that could limit your flexibility or put your business in jeopardy?

If your debt agreements have harsh penalties for late payments or other stipulations, you might find yourself in a tight spot. Always read the fine print and consult with a financial professional if needed.

5. Building An Emergency Fund

Image source-Pexels

While it might seem counterintuitive to save money when you have debt, an emergency fund can be a lifesaver. Unforeseen circumstances can quickly turn manageable debt into a crushing burden. By setting aside funds specifically for emergencies, you create a financial buffer that can help you weather unexpected challenges without adding to your debt load.

6. Consulting Professional Assistance

If you find that debt is becoming overwhelming, don’t hesitate to seek professional help. Financial advisors, accountants, or credit counseling services can help you create a strategy to manage, reduce, or even eliminate your debt. They can also provide valuable insights tailored to your industry and unique financial situation.

In Conclusion

Small business debt is a double-edged sword. While it can provide the necessary capital to grow and thrive, mismanagement or over-extension can lead to financial distress or failure. The key is to understand your debt from various angles, monitor it vigilantly, and act proactively if warning signs appear.

By paying close attention to your debt-to-equity ratio, cash flow, interest rates, and loan terms, and by building an emergency fund, you can keep your debt in check. And remember, professional guidance is always available if you find yourself in uncharted waters. Ultimately, the question of how much debt is too much varies from one business to another, but a conscientious and well-informed approach will always serve you well in finding the balance that’s right for you.