Risk and Reward: Lessons from Betting and Investing for Smarter Financial Decisions

Both gambling and investing involve risk but the nature of risk varies greatly. Betting involves placing money on an uncertain outcome – often with immediate results. Instead, investing seeks long-term wealth accumulation through appreciation of assets.

For example, in Aviator the principle of calculated risk-taking is illustrated. Players choose when to cash out before the multiplier crashes, like investors do when buying or selling stocks. Betting heavily depends on luck but smart moves like bankroll management and understanding odds can improve outcomes. Similar to investing, diversification, patience and thorough market research help.

The big difference is the expected returns. Although stock markets have historically returned an average of about 10% annually, casino games and sports betting are designed to give the house an edge – and long-term losses are more likely. Understanding the differences helps individuals decide where to spend their money.

The Psychology of Winning and Losing Money

The emotional responses to gambling losses cause impulsive decision making. Loss aversion – feeling the pain of losses more than the pleasure of gains – is found in gamblers and investors, behavioral finance studies suggest. This can cause irrational choices such as chasing losses in gambling or panic-selling investments during market downturns.

Nobel Prize winning economists Daniel Kahneman and Amos Tversky found that people generally need a gain twice as big as a loss to be emotionally balanced. This psychological bias explains why some gamblers keep betting when they lose to try to recover and why some investors hang onto poor performing stocks longer than they should.

Understanding such psychological tendencies is critical. In investing, dollar-cost averaging – investing a fixed amount at regular intervals – may temper emotional decision making. Set loss limits for gamblers and walk away when you reach them.

The gambler’s fallacy also causes people to place irrational bets: believing that past results determine future probabilities. A gambler who sees a roulette wheel land on red five times may think black is “due” next. Similarly, investors might expect a stock to rebound because it dropped without proving that fundamental analysis supports the assumption. Recognizing such cognitive biases might enhance financial decision-making in both domains.

Managing Your Bankroll: Gambling Budgets vs. Investment Portfolios

Betting requires disciplined financial management as does investing. Bankroll management involves setting a budget, placing bets wisely and not chasing losses. Some professional bettors employ mathematical methods like the Kelly Criterion to optimize bet sizing relative to perceived edges and risks.

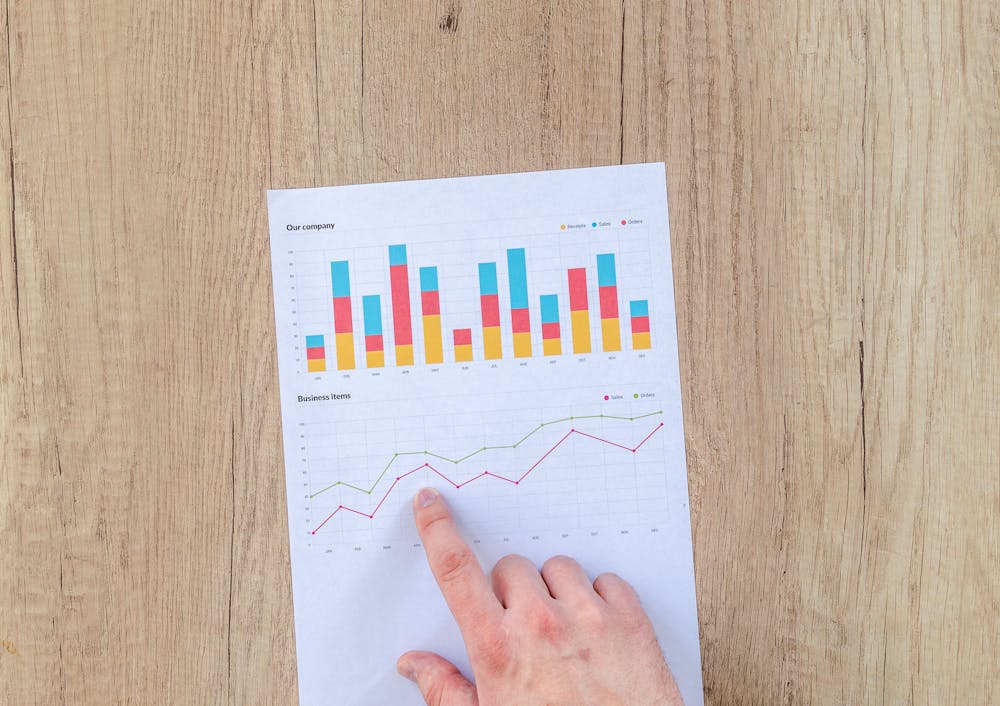

In contrast, investment portfolios require risk-return asset allocation strategies. A diversified portfolio spreads investments across different asset classes – stocks, bonds and real estate – to spread risk. Vanguard said a 60/40 portfolio (60% stocks, 40% bonds) has historically provided healthy growth and stability.

Another difference is the compounding concept. While a successful bet pays out once, investments grow exponentially with reinvested earnings. An investor who invests USD 10,000 at 7% a year will see their money double in about 10 years thanks to compound interest. This principle shows how long-term financial planning is important.

Both involve assessing risk tolerance and setting financial limits. Be it placing a bet or investing in the stock market, disciplined money management is the key to financial success.

Short-Term vs. Long-Term Mindset

The time horizon is another big difference between betting and investing. Generally speaking, betting is short term with outcomes decided almost immediately whereas investing involves long term wealth creation.

Dalbar, Inc. research shows the average equity investor underperforms the market largely due to poor timing decisions. In 20 years, the S1and1P 500 returned 8.2% annually but the average investor only received 4.3%, largely due to emotional trading. This highlights the need for patience and a long-term view of investing compared to betting.

This can also lead to a bias toward extreme risk/reward situations that may not work well with investing. The stock market demands patience and sound decisions, while quick profits often tempt those who bet. Learning to distinguish the two can help people tailor their financial strategy to their long-term objectives.

They both involve risk and reward but differ in structure, expected returns, and financial strategies. These distinctions may help someone gamble responsibly or build wealth for the future. Learn how to distinguish between calculated risks and impulsive decisions and then discipline your money management.

Beating and investing both require an understanding of risk tolerance and personal financial goals. People who recognize their own biases and use sound financial strategies, such as setting tight budgets for betting and diversifying investments, can make better decisions. And time must not be ignored in financial decision-making either; the thrill of immediate betting results contrasts with the patience required for long-term investing success.

Better financial literacy helps in both areas. Good money management applies whether someone is betting on entertainment or building an investment portfolio for retirement. A long-term view, clearly defined financial limits, and consequences of risk may help people gamble or invest more confidently and safely.